Massachusetts Paid Family & Medical Leave

Table of Contents

Background

Beginning October 1, 2019, Massachusetts will require employers and employees to pay premiums for a Paid Family and Medical Leave plan. Depending on how many employees are in the company this can either be paid for through either an employee deduction or an employee deduction and an employer expense.

If you offer a qualifying Private Plan to your workforce with benefits greater than or equal to the benefits provided by the PFML law, you can apply for an exemption. Self-insured employers must provide a bond even if granted an exemption.

When preparing a W2 the amounts paid towards Paid Family & Medical Leave should go in box 14.

You can find more information about Massachusetts’s Paid Family and Medical Leave on the state website.

Please see the Paid Family and Medical Leave Calculator for details on contribution amounts.

2025 Contribution Rates

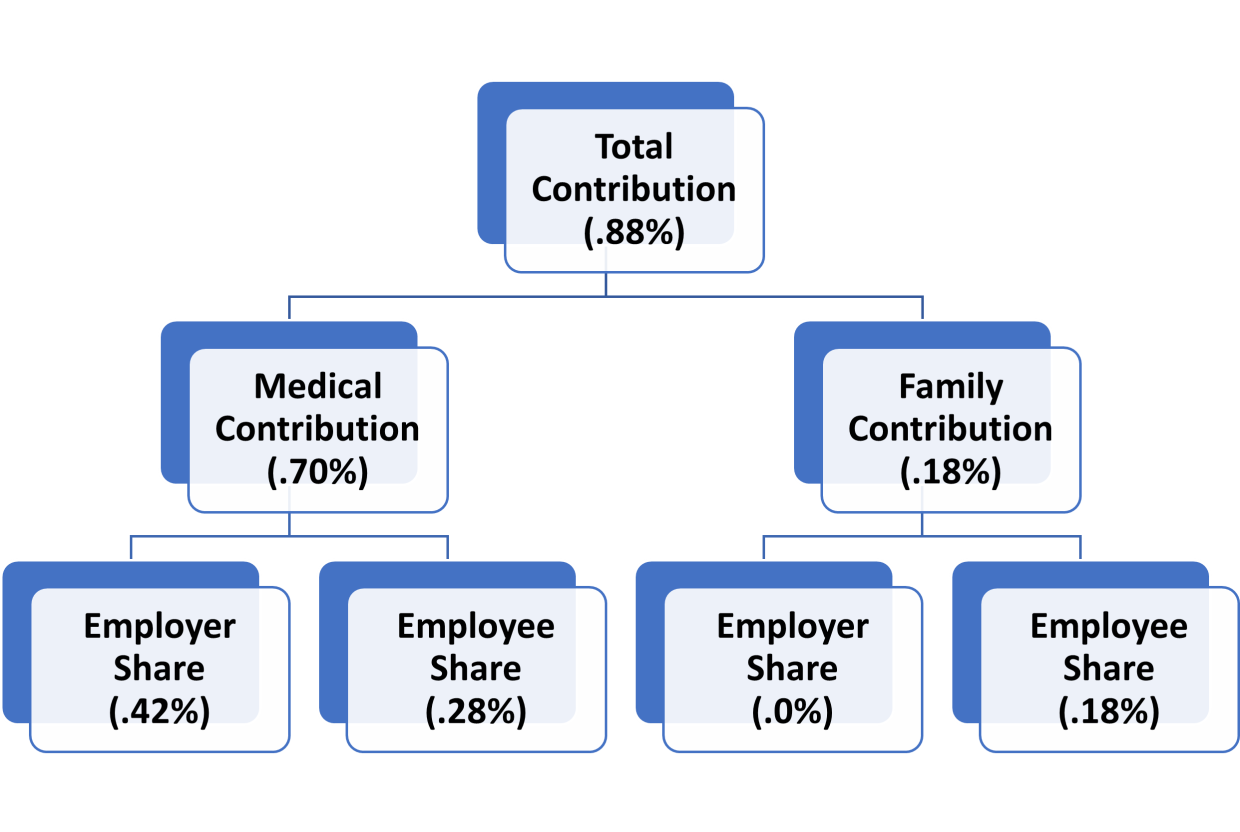

Employers with 25 or more covered individuals

Contribution of 0.88% of eligible wages split between Employee (0.46%) and Employer (0.42%)

Medical Contribution of 0.70%

Employer 0.42%

Employee 0.28%

Family Contribution of 0.18%

Employee 0.18%

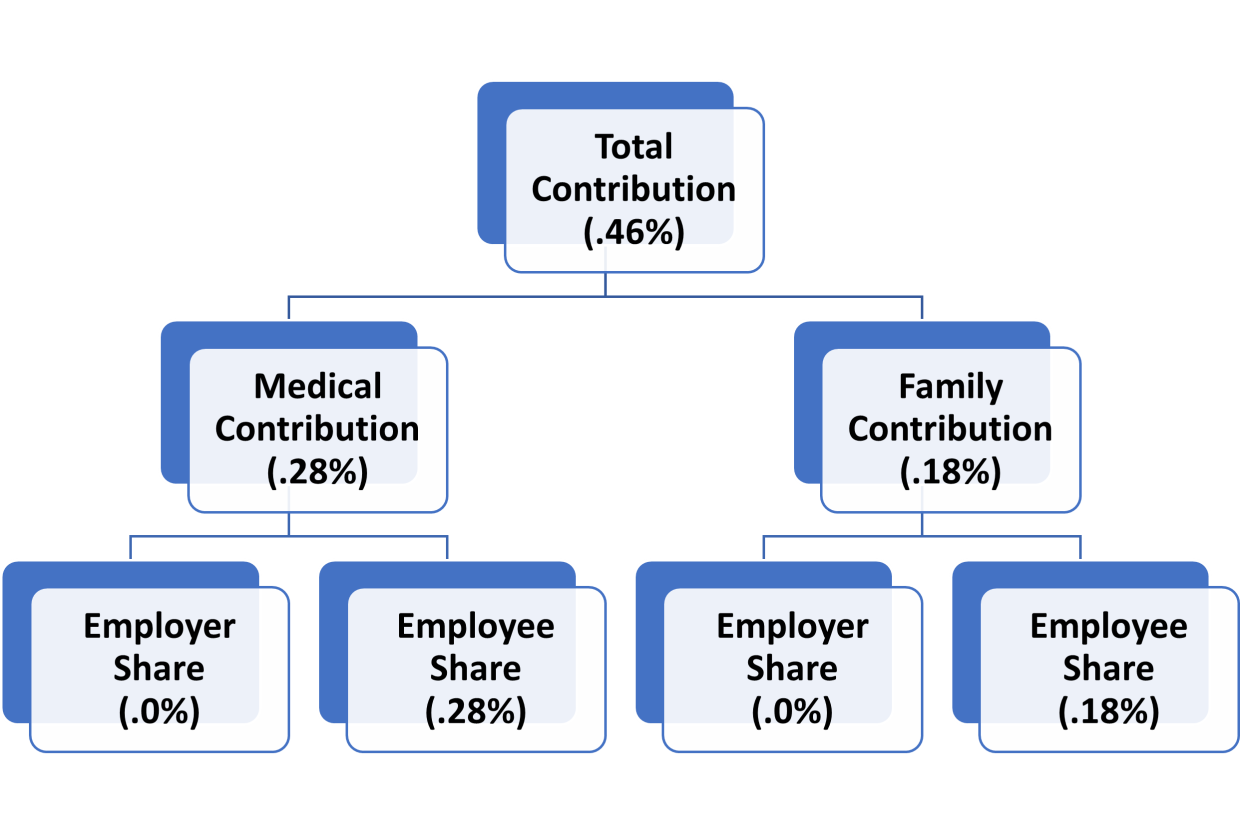

Employers with fewer than 25 covered individuals

Contribution of 0.46% of eligible wages covered by Employees (0.46%). This contribution rate is less because small employers are not required to pay the employer share of the medical leave contribution.

Medical Contribution of 0.28%

Employee 0.28%

Family Contribution of 0.18%

Employee 0.18%

AccountEdge Setup

Employee Responsibility

Employers must withhold PFML contributions from employees’ paychecks. This is handled through a Family Leave and Medical Leave Employee Deduction Categories. You must create these two Employee Deductions.

Set Up Massachusetts Family and Medical Employee DeductionMAs

MA - Family Leave Employee Deduction

Go to Payroll > Payroll Categories > Deductions

- Select the MA - Family Leave Employee Deduction and click Edit. If the MA - Family Leave Deduction does NOT exist, click New, and enter the name MA Family Leave

- Type: Paid Family Leave (MA Only)

- State: MA

- Type of Deduction: Select the second radio and enter the 2025 rate of 0.18% and select Percent of Gross Wages.

- Deduction Limit: Select the third radio and enter the 2025 annual limit $316.98 and select Dollars per Year.

- Click the Employee button to add MA - Family Leave to all Massachusetts Employees

Medical Leave - MA Employee Deduction

Go to Payroll > Payroll Categories > Deductions

- Select the MA - Medical Leave Employee Deduction and click Edit. If the MA - Medical Leave Deduction does NOT exist, click New, and enter the name MA - Medical Leave

- Type: Paid Medical Leave (MA Only)

- State: MA

- Type of Deduction: Select the second radio and enter the 2025 rate of 0.28% and select Percent of Gross Wages.

- Deduction Limit: Select the third radio and enter the 2025 annual limit $493.08 and select Dollars per Year.

- Click the Employee button to add MA - Medical Leave to all Massachusetts Employees

Employer Responsibility

If you are required to contribute to the program, this will be handled through an Employer Expense.

The PFML - MA Employer Expense is automatically created. The wage limit will be automatically updated, but you must set your PFML rate based on your employee count (refer to the details below).

Set Up Massachusetts PFML Employer Expense

Go to Payroll > Payroll Categories > Expenses

- Select the PFML - MA Employer Expense and click Edit.

- This Employer Expense has a type of PFML and a State Code of MA

- Enter the appropriate PFML Rate based on the number of employees you have. (0.0% if you have less than 25 employees or 0.42% if you have 25 or more Employees).

- Click the Employee button to add PFML - MA to all Massachusetts Employees.